Conclusions ‘predictable’, but to spin it as clean chit to Adani Group ‘wholly bogus’: CongConclusions ‘predictable’, but to spin it as clean chit to Adani Group ‘wholly bogus’: Cong

New Delhi: With a Supreme Court-appointed expert committee stating that it cannot conclude any regulatory failure around Adani Group’s stock rallies, the Congress on Friday said the conclusions were “predictable” but to spin the report as having given a clean chit to the conglomerate is “wholly bogus”.

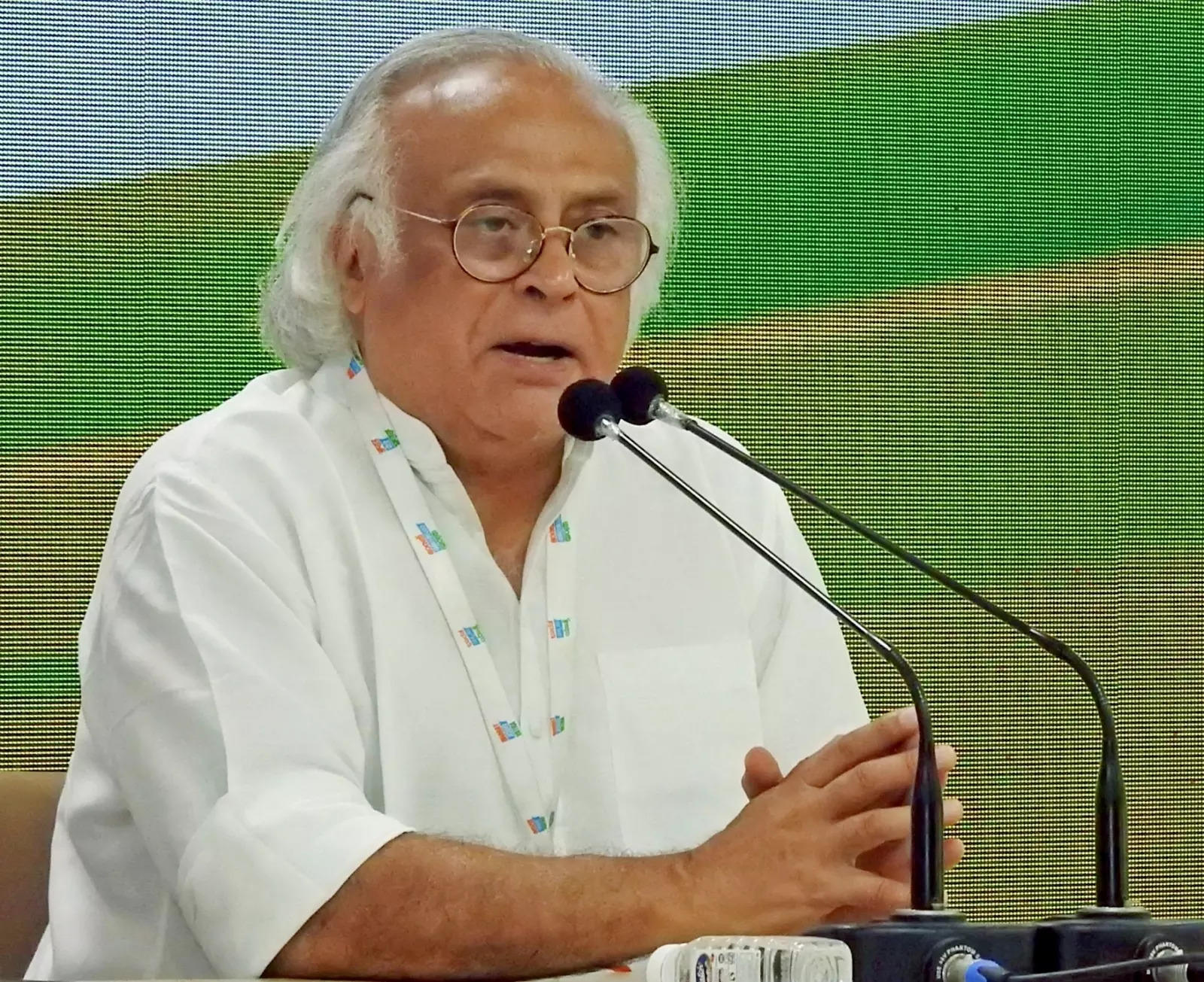

Stressing the need for a joint parliamentary committee probe, Congress general secretary Jairam Ramesh said the party has all along been saying that the expert panel appointed by the Supreme Court has “extremely limited terms of reference and will simply be unable (and perhaps unwilling too) to unravel the Modani scam in all its complexity”.

In its report, the expert committee has said that the Securities and Exchange Board of India (SEBI) has “drawn a blank” in its probe into alleged violations in money flows from offshore entities into the conglomerate.

But the six-member panel said there was an evidence of a build-up in short positions on Adani Group stocks ahead of the report of US-based short seller Hindenburg Research, and profiting from squaring off positions after prices crashed post-publication of the damning allegations.

Reacting to the report, Ramesh in a long post on Twitter highlighted five observations from the report and said “contrary to the boasts of the Modi government, the Committee has found that regulations have moved in direction of opacity that facilitates the disguise of ultimate beneficial ownership”.

The committee is unable to come to any definitive conclusion regarding violation of SEBI laws by the Adani Group, he said.

Since no definitive conclusion can be drawn on the basis of information it had, the Committee concludes that there has been no regulatory failure by SEBI, Ramesh said.

“We wish to highlight these two excerpts from page 106 and page 144 which strengthens the case for a JPC. a) ‘SEBI is unable to satisfy itself that the contributors of the funds to the FPIs are not linked to Adani’ – which brings us back to the question of the unaccounted funds of at least ₹20,000 crores. b) ‘LIC was the largest net buyer of Adani securities with the purchase of 4.8 crore shares when the price shot from ₹ 1031 to ₹ 3859’ – which raises the question on whose interest was LIC acting,” he said.

The Congress wishes to say nothing more on the committee’s report given the eminence of its members, except to say its conclusions were predictable and with all its limitations to spin the Committee’s report as having given a clean chit to the Adani Group is wholly bogus, Ramesh added.

Other Opposition leaders reacted to the report with Shiv Sena (Uddhav Thackeray faction) leader Priyanka Chaturvedi saying the expert committee had a golden chance to ensure loopholes addressed and accountability fixed in corporate governance, stock market regulation and regulatory body’s accountability but by “giving solutions on financial literacy and leaving the rest to SEBI investigation outcome, giving SEBI a wide berth on FPI is such a let down, but not surprising”.

In its report submitted to the Supreme Court, the panel said, “At this stage, taking into account the explanations provided by SEBI, supported by empirical data, prima facie, it would not be possible for the committee to conclude that there has been a regulatory failure around the allegation of price manipulation.” It further said there is a need for an effective enforcement policy that is “coherent and consistent” with the legislative position adopted by SEBI.

According to the committee, it also cannot say that there has been a regulatory failure on SEBI’s part on minimum public shareholding rules or on related party transactions.

The apex court had appointed the committee parallel to the investigation that markets regulator SWBI was conducting into allegations against Adani Group and the plunge in the apples-to-port conglomerate’s shares, triggered by Hindenburg’s allegations.

The expert panel was headed by retired Supreme Court judge AM Sapre and also comprised OP Bhatt, KV Kamath, Nandan Nilekani and Somsekhar Sundaresan.

“The investigation and enforcement have moved in the opposite direction, stating that the ultimate owner of every piece of economic interest in an FPI must be capable of being ascertained. It is this dichotomy that has led to SEBI drawing a balance worldwide, despite its best efforts,” the report said.

Without such information, SEBI is unable to satisfy itself that its suspicion that has been aroused can be put to rest.

“The securities market regulator suspects wrongdoing but also finds compliance with various stipulations in attendant regulations. Therefore, the record reveals a chicken-and-egg situation,” it said.